Foreclosure Laws

It can be a scary moment to realize that the home you are living in, the home you have made memories in, could be taken away from you. When hardships happen and mortgage payments become impossible to make, lenders have three months before they can start the foreclosure process.

Some lenders are willing to give homeowners the option of doing a short sale rather than a foreclosure. Unfortunately, the homeowner will still lose the home; however, a short sale won’t hurt a borrower’s credit as much as a foreclosure – which will make it a little easier purchase again in the future. The lender approves the short sale knowing they will be taking somewhat of a loss, albeit a smaller one.

When the foreclosure process is extended and prolonged, as it can be in judicial states, the bigger the loss for banks, which is why short sales can be a good option for lenders. When homes sit empty for too long, deterioration begins. Yards are overgrown, vagrants can move in and empty homes become beacons for vandalism and theft – all of which costs the bank in repairs and sale prices.

A lot of foreclosure homes that have been vacant for a while, and need substantial repairs, have to be sold as all cash sales or though 203(k) rehab loans, which assist the purchaser in repairing the home.

Another option that lenders sometimes extend to homeowners in place of foreclosure is a loan modification. Modification can happen in various forms, whether that’s lowering borrower’s interest rates or extending the life of the loan.

|

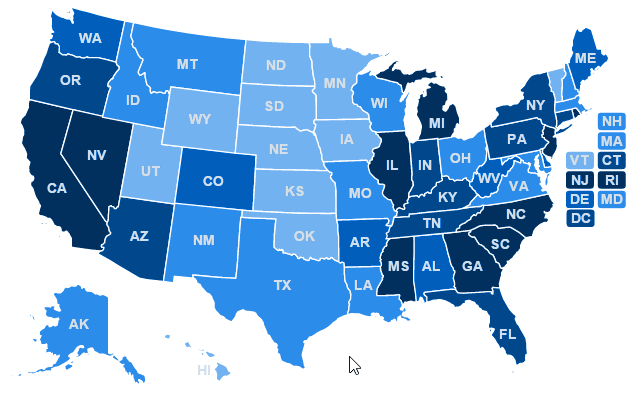

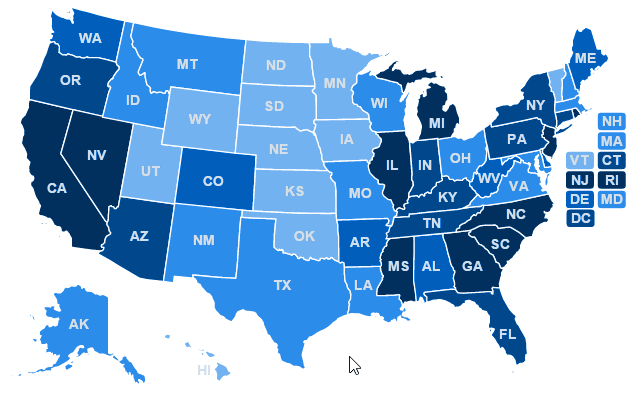

Search Foreclosures! Click on your location:

Foreclosure Homes |

Foreclosure Process |

Foreclosure Laws |

Purchasing a REO or HUD Home |

Dollar Foreclosure Program |

| |